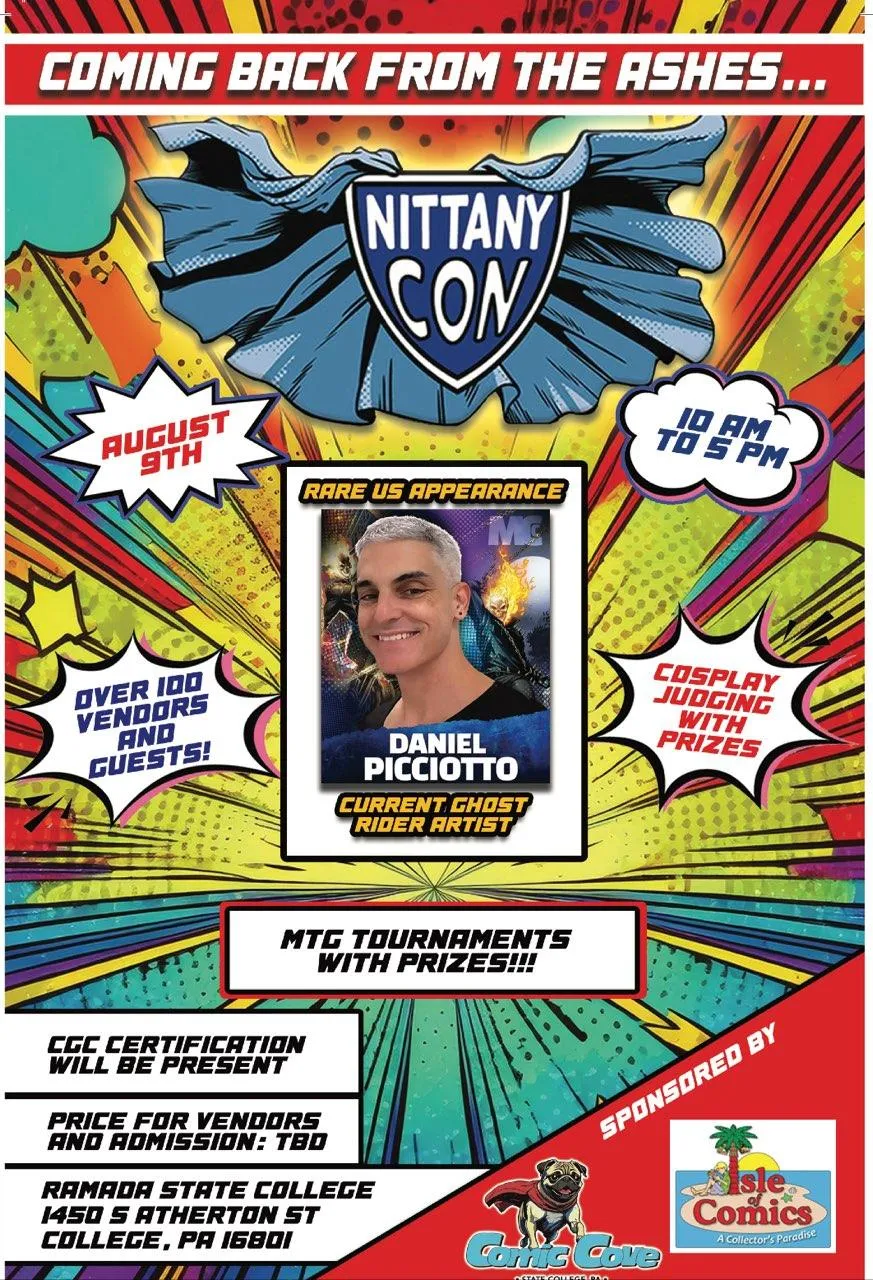

NITTANY CON

Comic Book Convention in State College,PA

August 9th, 2025

10:00am -5:00pm

Ramada by

Wyndham State College Hotel & Conference Center

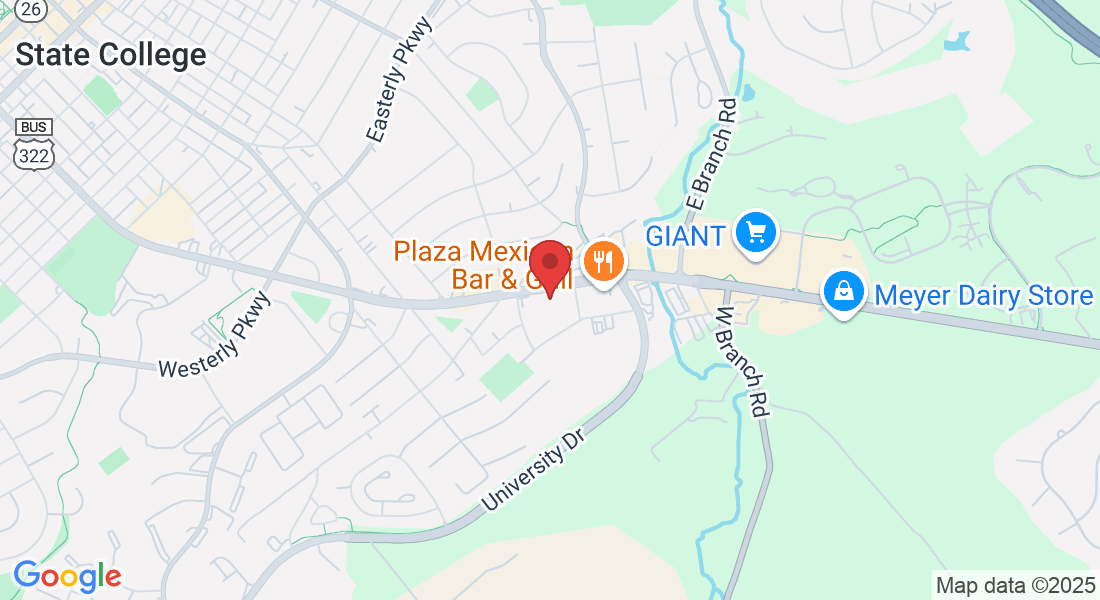

1450 S Atherton StState College, PA 16801

Welcome to Nittany Con

Welcome to Nittany Con, the premier comic book convention in State College, PA! Nestled in the heart of Nittany Valley, Nittany Con is a celebration of all things pop culture, from comic books and graphic novels to anime, cosplay, gaming, and beyond. Whether you’re a lifelong fan or new to the world of comics, our convention offers something for everyone.

Founded by passionate fans, Nittany Con brings together creators, artists, and enthusiasts for a weekend filled with exciting panels, workshops, artist alley, and vendor booths. Our mission is to create an inclusive, vibrant space where fans of all ages can connect, share their love for their favorite fandoms, and discover new ones.

Located in the vibrant town of State College, home to Penn State University, Nittany Con is not just an event—it’s a community. Join us and be part of the magic that makes Nittany Con the must-attend event of the year in Central Pennsylvania. Whether you’re here to meet your favorite artist, find that rare comic book, or simply enjoy the atmosphere, we can’t wait to welcome you to Nittany Con!

Featured Guests

Daniel Picciotto

Daniel Picciotto is a dynamic voice in the world of comic books, known for his unique storytelling and captivating artwork. With a passion for both writing and illustration, Daniel has carved out a niche in the industry with his ability to blend intricate narratives with visually stunning art. His work often explores themes of heroism, identity, and the human condition, resonating with readers across all ages.

Starting his career as a self-taught artist, Daniel’s journey into the comic book world was fueled by a love for the medium that began in childhood. Over the years, he has developed a distinctive style that combines traditional comic book aesthetics with modern influences, making his work both nostalgic and fresh.

Daniel’s dedication to his craft has earned him a loyal following, as well as critical acclaim within the industry. His stories are not just about superheroes—they’re about the complexities of life, the struggles we all face, and the triumphs that define us.

Kevin Conrad

Kevin Conrad is a distinguished comic book artist renowned for his dynamic inking and storytelling. He began his comics career in 1993, contributing to titles such as X-Force, Cable, and Wolverine. Over the years, Kevin has collaborated with major publishers, including Marvel, DC Comics, and Image Comics, lending his talents to iconic series like Spawn, KISS: Psycho Circus, and Spawn: The Dark Ages.

Kevin initially worked in commercial advertising, creating product illustrations for clients such as Price Chopper, Troy-Bilt, Scholastic Magazine, and GE. However, his passion for comics led him to pursue a career in the industry, where he quickly made a name for himself.

Throughout his career, Kevin has contributed to various DC and Image properties and has taken on more penciling projects with independent companies and through commission work. His art combines bold creativity with a deep respect for the comic medium's history, creating pieces that resonate with both longtime fans and new audiences.

Our Sponsors

Comic Cove